Study Table Gst Rate

Where the supply is made learn about the place of supply rules. ChapterHeading Sub-heading Tariff item Description of Goods 1.

Gst Rate On Wood And Wooden Furniture Indiafilings

Or 5 per cent.

Study table gst rate. You have to only type name or few words or products and our server will search details for you. You should use this table if you make fortnightly payments and your employee has. 6Territorities Nunavut and Yukon and Province of Alberta charge GST at the rate of 5.

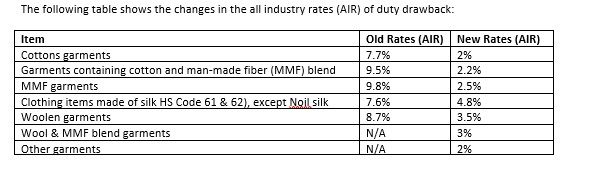

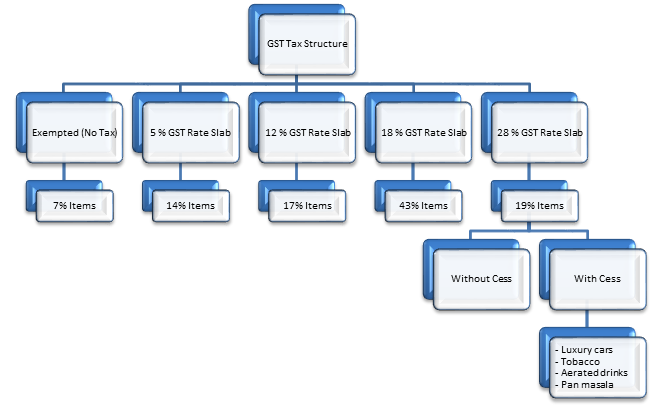

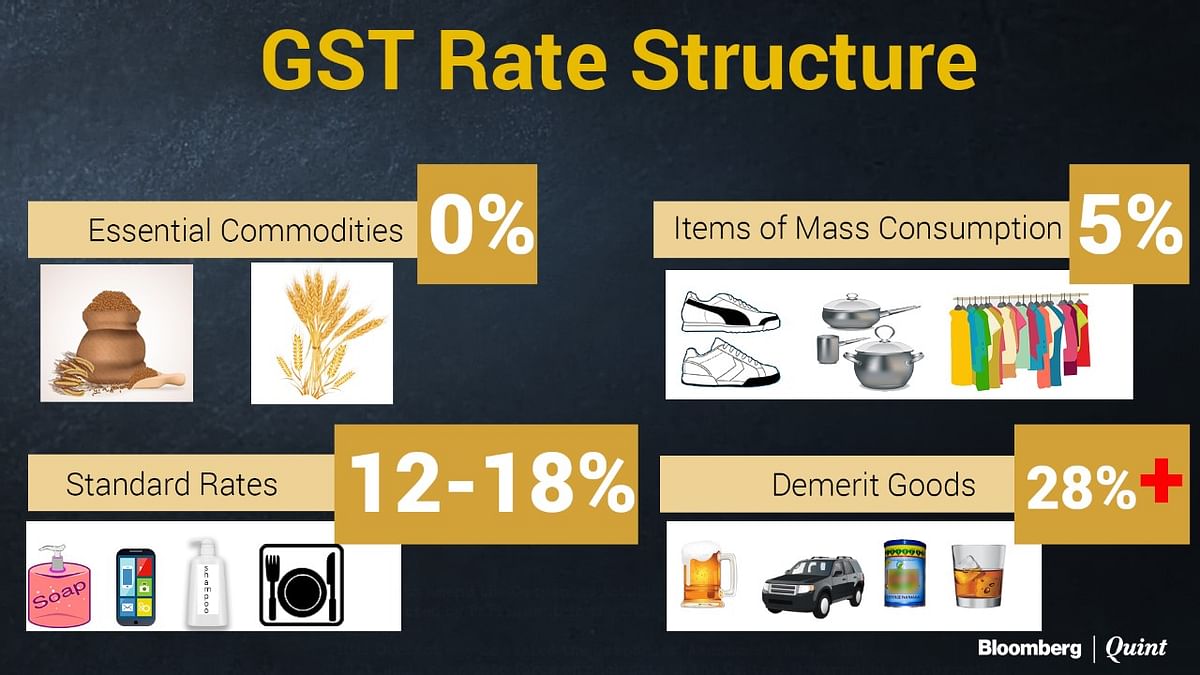

They are 5 GST 12 GST 18 GST 28 GST. Seats other than those of heading 9402 whether or not convertible into beds and parts thereof. GST rates for all HS codes.

You can search GST tax rate for all products in this search box. 14행 The following table provides the GST and HST provincial rates since July 1 2010. Type of supply learn about what supplies are taxable or not.

STUDY TABLE FURNITURE China. Table of Contents Highlights of 44st GST Council Meeting. Brass Kerosene Pressure Stove.

You are adviced to double check rates with GST rate. Barbers chairs and similar chairs having rotating as well as both. 1Use this table for payments made from 1 July 2021 to 30 June 2022.

For convenience goods have been organised rate-wise in schedules I to VII as per details given below. The rate you will charge depends on different factors see. Add to Compare View Product.

Use the study and training support loans component look-up tool XLSX 23KB This link will download a file to quickly work out the fortnightly component. Goods and services tax GST is a broad-based tax of 10 on most goods services and other items sold or consumed in Australia. Table kitchen or other household articles of aluminium.

Most goods and services supplied in or imported into Canada are taxable supplies and are subject to GST at the rate of 5 or HST in the range of 13 to 15 federal component of 5 and provincial component of 8. Though there are five slab rates but consultancy services falls under 18 slab only. Attend our GST webinar to help you to understand GST and its implications for business.

16 to 28 Awareness of GST Cross tabulation The above table is showing the cross tabulation in between GST rate and awareness of GST among respondents. 0102 Live bovine animals. Medical surgical dental or veterinary furniture for example operating tables examination tables hospital beds with mechanical fittings dentists chairs.

HSN Code Chapter Description Rate Cess 9401. Or Nil where only content is supplied by the publisher and the physical inputs including paper used for printing belong to the printer. In this cross tabulation it is clear that out of 75 respondents 70 respondents have aware of GST and remaining 5 respondents have not aware of GST.

24Rate of GST 1 Services by way of printing of all goods falling under Chapter 48 or 49 including newspapers books including Braille books journals and periodicals which attract IGST 12 per cent. Thereafter there has been a constant endeavor for the introduction of the GST in the country whose culmination has been the introduction of the Constitution. Consultancy services attracts 18 of GST Rate.

In India GST rate for various goods and services is divided into four slabs. 5GST rate on consultancy services. Who the supply is made to to learn about who may not pay the GSTHST.

LIST OF GOODS AT NIL RATE The GST rate structure for goods have been notified. Table kitchen or other household articles of copper. Tax rates are sourced from GST website and are updated from time to time.

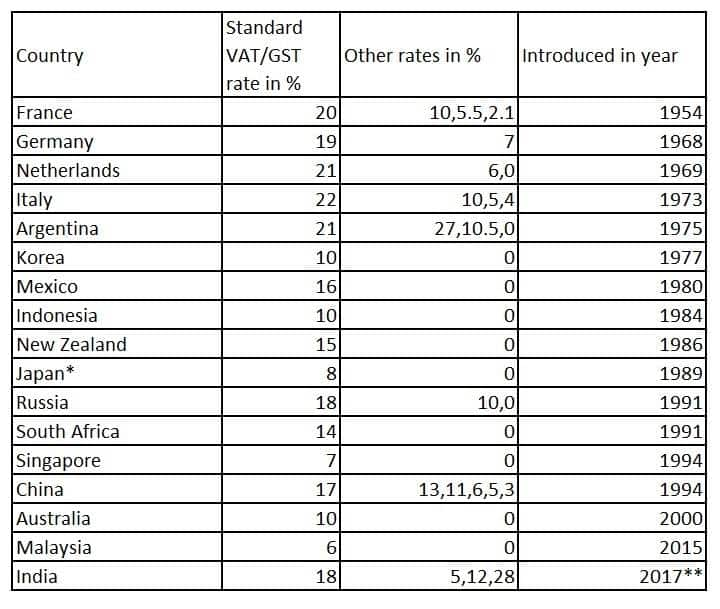

0101 Live asses mules and hinnies 2. 15LIST OF TABLES Table Page 11 Number of countries that have adopted GST based on regions 4 12 Selected countries and the current rate of GST in each country 4-5 13 Current GST rate and inflation rate in each country 10-11. Study Tables 40 Options.

Some things dont have GST included these are called GST-free sales. 6RATE OF GST ON GOODS SCHEDULE I. Consultancy can be of any nature related to healthcare finance investments etc.

2Table kitchen or other household articles of iron. Dont show these suggestions to me again. The genesis of the introduction of GST in the country was laid down in the historic Budget Speech of 28th February 2006 wherein the then Finance Minister laid down 1st April 2010 as the date for the introduction of GST in the country.

16GST rate is favourable ie.

2 Gst Rates On Bamboo Products Download Table

Hsn Code List Gst Rate Find Gst Rate Of Hsn Code Hostbooks

Gst Rate For Stationery Products Pen And Paper Indiafilings

Real Estate New Gst Rates And Challenges

2 Gst Rates On Bamboo Products Download Table

Gst Rate Structure India 2020 Gst Rates Item Wise List Pdf Exam Updates

Gst Vat Rates In Asean Countries Download Table

Gst In Sports Parents Pay Steep Price As Sports Summer Camps Charge 18 Gst Bengaluru News Times Of India

Gst Rate Structure India 2020 Gst Rates Item Wise List Pdf Exam Updates

Gst Payable For Sale Of Furniture Lamps Bedding Mattress

Gst Rate Structure India 2020 Gst Rates Item Wise List Pdf Exam Updates

How Gst Stands Today Fibre2fashion

Hsn Code Gst Rate For Printed Books Newspapers And Postal Goods Chapter 49 Tax2win

Gst Rate Changes For The Year 2020 2021 Vakilsearch

Gst Rate Slabs Simplified Kotak Bank

How Much Is The Gst For Wooden Furniture In India Quora

India Gst The Four Tier Tax Structure Of Gst

India Joins Global League Here S The List Of Gst Rates Across The World

Post a Comment for "Study Table Gst Rate"